Ample supplies and a mild winter have caused natural gas futures to drip down into multi-decade low support levels. The market has reached the sub-$2 level a handful of times in the last 20 years, which proved to be a value zone many times. The market still looks negative, but it is time to think about a long term bottom. However, many small traders have been trying to pick the bottom in this market for some time and only have losses and frustration to show for it.

I have been writing for many months that the supplies of natural gas have been burdensome and an extremely cold winter would be one of the few things that could save this market. Mother Nature only served to lead the way for lower prices this winter so far. Prices recently breeched the $2 psychological level and now hover around $1.896. I don’t believe the fundamentals warrant a major bottom just yet, but one more leg lower could setup a very attractive risk to reward trade for the long term.

Natural Gas Fundamental Setup

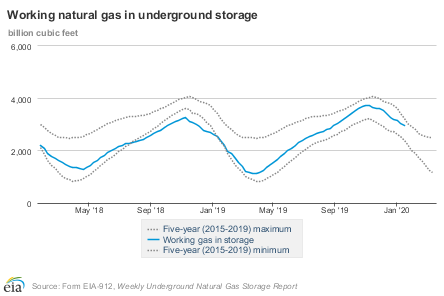

What can I say? It is bad. Inventories are well above the five year average for this time of the year. Natural gas supplies typically get drawn down heavily during the winter months. This winter started off with natural gas supplies at hefty levels and the draw this year has been well below expectations. If this scenario continues through February, the fundamentals will look more negative.

There has been a good deal of talk about the rig counts dropping for natural gas. The logic is that less rigs drilling should equal less production. That has not really materialized yet. It may eventually be a positive factor, but it looks like the large rigs are having no trouble keeping production rolling. Extreme low prices typically lead to less production for most commodities. The problem here is that natural gas is often a byproduct of drilling for oil. It is doubtful that the pace of oil drilling will decline much unless prices drop into the low 40’s.

The reason why the rig counts have dropped is due to the fact that many smaller producers simply can’t sustain the economics of the low prices. Some of the less desirable sites also get shuttered due to the estimated volume and transportation costs. As prices get lower from this point it is likely that more marginal sites will stop production.

The demand side has obviously been hurt by the mild winter to this point. The recent development of the Coronavirus certainly isn’t helping the cause, but natural gas will suffer little compared to many other commodities if the threat escalates. A decrease in economic activity in China, around the world and possibly in the US certainly won’t help on the demand side.

The economics of cheap natural gas prices should be supportive from a long term perspective. Natural gas is a clean burning fuel and will likely be used in place of other fuels. Power plants have been replacing coal with natural gas and that pace should continue. The big picture still looks negative for natural gas, but markets always look worse near the bottoms. The charts and prices will help give a clearer picture on determining a bottom.

The Technical Picture

Reading the charts is fairly simple for natural gas. The market is in a long term downtrend. The COT Report has the large traders extremely short. The large traders will follow the trend, but it can sometimes signal a market extreme when they get too long or short. Natural gas futures have also become very oversold. The biggest factor in my analysis is the multi-decade support levels around $1.60 – $1.70. The market is not too far from there and is it is getting into a solid value zone. In an ideal world, I would wait to buy around $1.60. At the very least, there should be a solid bounce off that level if it gets down there. However, it might not get there. Where will the bottom be?

How to Trade Natural Gas from Here?

The market is still in a downtrend and I would trade from the short side for shorter term trades. However, this market could be near a major bottom in the next few months and I would look for an opportunity to find an entry for a long term buy. I would want to see another push lower and some more time pass for an ideal setup. However, long-term bottoms rarely flash a neon sign to buy.

Small speculators have been getting burned looking for a bottom in this market. Major bottoms don’t happen overnight. They often take a great deal of time trading sideways at the lows before they move higher. It will probably take patience to catch the bottom in this market and profit from it. I am not necessarily looking to use a long futures position(s) to trade a bottom if we drop further from here. Rather, I would look to use a more advanced option strategy or a spread with futures and options to position properly for catching a bottom. Such strategies can help lower the risk and still provide solid upside potential. Feel free to contact me to discuss how I would position strategies for the natural gas market.