Natural gas is suffering the woes of plentiful supplies this year and the lack of a catalyst to push prices higher. As a result, natural gas futures prices have dropped about 28 percent from the peak this year in March. The fundamental picture doesn’t look good at this point and the market will probably need some significant and unexpected development to push prices out of the cellar. Currently, the best thing natural gas might have going for itself is the price has gotten very low.

Natural Gas Supply Situation

In the latest supply numbers released from the US Energy Information Administration – EIA as of August 16, working natural gas in storage was 2,797 Billion cubic feet. This is 369 Bcf higher than last year at this time and 103 Bcf below the five year average of 2,900 Bcf. Some might look at this and focus on the fact that supplies are 103 Bcf below the five year average. However, the main concern here is that natural gas supplies are 369 Bcf higher than last year.

Supplies are building and abundant at this time. That is typically not a good formula for prices moving higher. There were a number of natural gas plants that were down for maintenance, but they are coming back up on schedule. There really aren’t any known issues in the market that would cause a loss of production in the foreseeable future.

In the graph above, it is important to watch the trend of the blue line (current supply) versus the grey line (5-year average). The blue line is catching up to the grey line, not moving away from it. This indicates that the trend in supplies is growing at a higher rate and that should be negative for prices going forward.

Why Supplies are Building in Natural Gas

There are two main issues to explain this. This first is that the economy may be slowing slightly and this summer didn’t have extreme heat. This would certainly lead to mild demand and allow supplies to build. The second consideration is that the US is producing a great deal of energy. Oil production is running at a torrid pace and doesn’t appear to letup any time soon. Much of this is attributed to production from the shale formations like Marcellus, Bakken, Eagle Ford and Permian Basin.

The trend in higher oil production by the US also means an increase in natural gas production. Where you find oil, you find gas! That’s what has been so sweeping to the industry with all these massive shale formations. There has been no shortage of natural gas to produce. In fact, oil drillers will sometimes just burn the natural gas to get rid of it. This is called flaring and there are some environmental concerns for using this process, but it shows how much gas is available. It is often cheaper to burn it than try to store and transport it into an often backlogged system.

There is an amount of gas that is basically wasted and this is partly due to the lack of infrastructure to transport the gas. However, the capacity will eventually increase, which will bring more gas to market. In fact, the Gulf Coast Express pipeline will bring more capacity later this year.

The natural gas industry typically builds inventories during the spring and summer months to gear up for peak demand during the winter months. This year went well and there appears to be plentiful supplies for the winter and that should put a cap on most rallies. A severe winter can draw supplies fairly quickly and change this picture, but a nice cushion in supplies will usually keep the rallies relatively short.

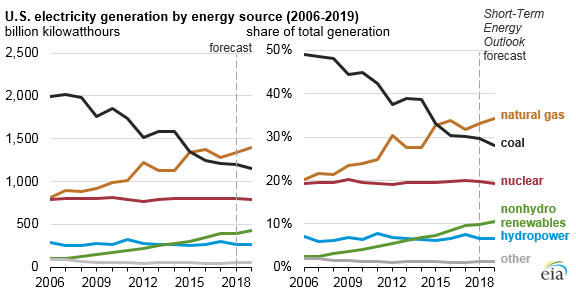

There has been a fairly steady rise in demand and supplies of natural gas in recent years. I already discussed many of the factors that are influencing the increased supplies, but there are also factors affecting increased demand. One of the main drivers is the increased use in electricity generation. Many electric plants have shifted to natural gas over coal. Natural gas has gotten relatively cheap in the last 10 years and it is becoming more attractive from an economic standpoint than coal, especially when it is around $2. Not to mention the environmental concerns of using coal, as natural gas is a much cleaner fuel. The trend is certainly toward increased natural gas usage for power plants.

Outlook for Natural Gas Prices

Overall, it is difficult to forecast what the market will do a year from now. The supply and demand equation doesn’t look to change too dramatically unless some new developments arise. The weather, hurricane threats or trade deals are things to watch. The 30-day weather forecasts have more mild temperatures across the US, which should call for slightly less natural gas demand. That has put pressure on prices and should keep rallies in check in the near term.

The market is currently trading at about $2.15. That is at the low end of the price range going back the last 20 years. The $2 level is kind of a psychological support area and I wouldn’t be surprised if the market tested that area. Some may like to buy at this area, as they feel there is solid value there. However, getting below $2 may be the real value area, especially closer to $1.60. I certainly wouldn’t want to chase the market on rallies closer to the mid $2 range. I see the value area closer to $1.80 and I think $1.60 could be the new $2 key level, as the market moves into a lower trading range in the future.

The most compelling point I see in my analysis of natural gas is that production looks like a tidal wave and almost seems unstoppable to slow. The US is pumping out oil like crazy and that keeps a tailwind for gas production. The questionable side here is demand. It has been on the upswing, but will it keep pace with production? A slowdown in the economy or a mild winter could cause a spike in supplies that may be hard to burn off with production running full steam.

To me, I see the range dipping below the $2 level on the low side and the high end of the range may be in the $2.70 area into next year. There is a seasonal tendency for natural gas to move higher from early August into October and then drop through February. This is just a tendency and I don’t recommend trading based solely on it, but it is something to incorporate into an overall analysis. The market is in a downtrend and sometimes a bottom in this market takes longer than expected to form. The prudent course of action is to sell rallies. There will be news events going forward that will inevitably cause some rallies. However, the overall trend is for lower prices and the fundamentals should help keep pressure on prices.