As I look through the longer-term commodity charts, I see one downtrending market after another. The main exception is the precious metals. The weakness in commodity prices seems to makes sense with the increased recession talk on the financial networks. Economic growth in Europe is anemic and may be recession bound in the near future. Now let’s not forget that the yield curve on Treasuries is flirting with inversion, which has been a fairly reliable red flag for recessions. So, the weakness in commodities must be signaling a recession too – right?

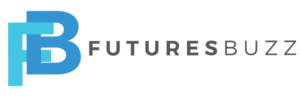

Not so fast! I wanted to look a little deeper into commodity prices and how they have performed before, during and after recessions. The data shows that commodity prices have a tendency to move higher over time to account for the impact of inflation on prices. The typical pattern I see is one of prices moving higher prior to a recession and a decline in commodity prices slightly before or during a recession.

Much of this analysis is basic economics. The typical economic cycle is usually comprised of a peak, contraction, trough and then expansion. The peak usually consists of highs in equity markets and commodities as well. It makes sense that there should be the greatest demand for commodities during the peak of economic activity. The problem here is that commodity prices have basically trended lower since 2008. The commodity markets did have a move higher into 2011, but the overall trend has been lower since.

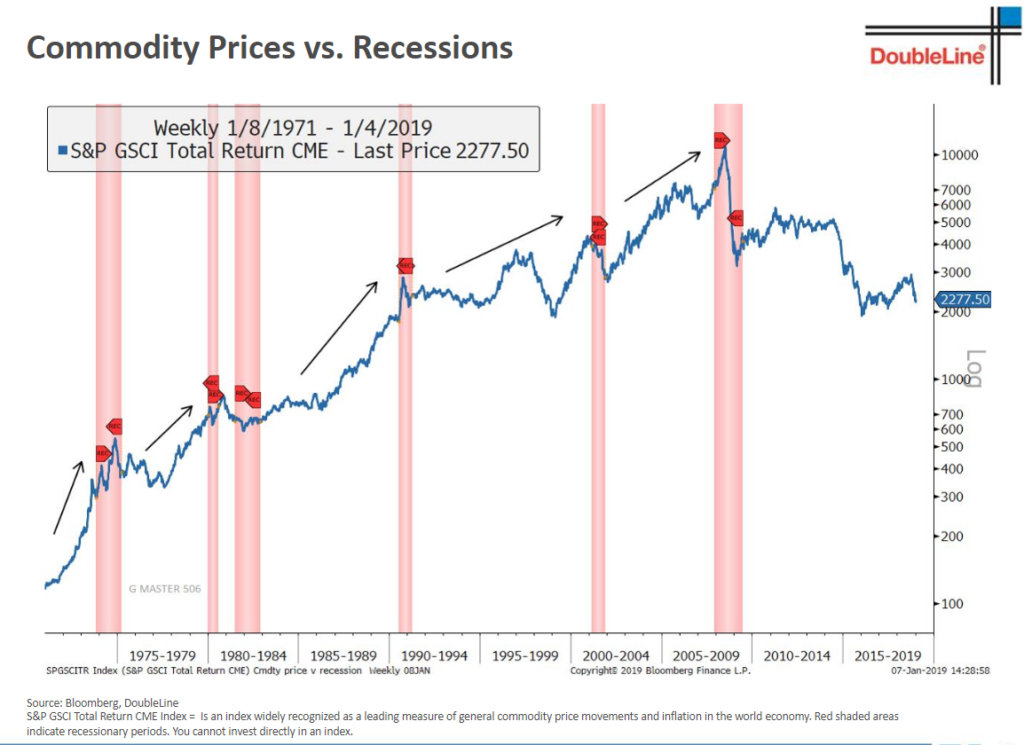

If the U.S. is heading into a recession, the lack of a substantial increase in commodity prices in the prior years doesn’t follow the typical pattern and economic reasoning. The stock market bottomed in 2009 and was a leading indicator of the economic recovery, albeit somewhat anemic. That makes one wonder why stocks would increase so strongly, but commodities didn’t follow suit.

A good explanation for this divergence might have to do with the overall trend with lower interest rates, debt and the possibility of deflation in many parts of the world. The U.S. economy was facing a financial meltdown in 2008 from the fallout of the housing crisis. The stock market fell more than 50% from its peak during the crisis. To combat this dire situation, the Fed embarked on a massive program of Quantitative Easing. There were several versions / rounds of it, which ultimately flooded the markets with liquidity. My thoughts were that this would eventually lead to higher inflation down the road and I was not alone. But that didn’t quite materialize.

The stock market was the main benefactor of the massive liquidity influx, even though the economy struggled to average about a 2% growth rate from 2008 – 2018. So what happened to commodities? It turns out there has been a prevailing force in the markets that is trending toward deflation. This is the complete opposite of the 1970s where inflation was the main problem. Treasury yields approached 20% and high interest rates were one of the tools used to curtail inflation. Maybe we are witnessing the complete reverse of the 1970s when it comes to commodity price trends around recessions. Or maybe there is no recession on the horizon for the U.S.

According to the trend in commodity prices since 2011, there has been a prolonged period of lower prices and this should traditionally signal an economic recovery or further expansion may be on the horizon. That would be quite interesting to think about. It certainly runs counter to the recession concerns in the headlines right now. However, this wouldn’t be the first time the pundits got it wrong or were overly concerned. Plus, the equity markets always have some hiccups during long bull markets.

It will be difficult to predict commodity price direction in the next 6 months or so. The first approach I take is that commodity prices have had a long period of declines and they should be due for a cyclical turn higher. That could happen if the US signed an attractive trade deal with China and trade strengthened around the world. Europe could also stimulate their economies once again and get back on track with a more vibrant North America and Asia.

Another approach is that Europe is weakening further and the US has more trade tensions with China. This could setup a scenario for weaker global growth and the same tools are used to stimulate economies around the world. This would consist of even lower interest rates and central banks would print more money to stimulate the banking system and economies. The big question is whether this has already been done exhaustively after 2008 and this won’t carry the same punch. In essence, it might be very ineffective and there might be serious underlying issues with the global economies that haven’t been resolved.

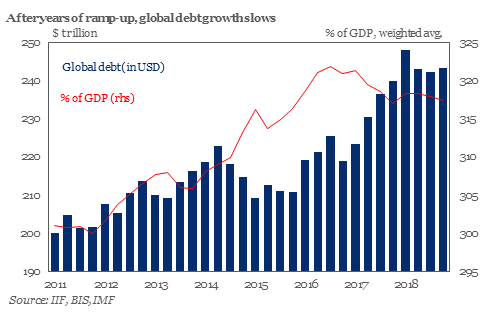

A glaring flag I see is the global debt situation. Has everyone been robbing Peter to pay Paul? Will this have to been cleaned up before we can get back to normal business cycles? It has been a rush to the bottom for countries, especially in Europe, to lower interest rates to try and get a competitive advantage. The European Central Bank set rates at 0% and Swiss rates are negative. Lower interest rates typically lead to weaker currencies and that may help with trade, not to mention lower interest payments on debt. I hate to imagine the stifling interest payments on debt if interest rates rose to a more historical norm of about 7%. That could be very troublesome for the U.S. and maybe tragic for many European countries.

It is unlikely interest rates will rise substantially anytime soon. Economies around the world need to play catch-up and remove the spare capacity in the system. Using staggering amounts of debt to push an economy beyond its equilibrium is not the long-term solution. I doubt there will be a worldwide solution to these economic issues anytime soon and that puts the markets in a sort of flux. That might be the situation we are in for the foreseeable future.

I would expect the global economy to meander for the next few years. Europe is certainly a concern for a deeper recession and concerns of debt defaults could make headlines once again. Commodity prices have dropped substantially from their highs and may be due for a cyclical turn higher. However, they will probably be lacking global economies that have a solid foundation for supporting enough increased demand to lead to a strong bull market. The overall trend for commodities is currently lower and I feel it is good to trade along with the trend until there is a material change.

When trying to figure out whether commodities are signaling that a recession is near, it just doesn’t make much sense at this point. There are too many variables from unprecedented Central Bank activity that are probably clouding this analysis. Commodities didn’t really rally enough to have a reversal. In fact, they did move higher from 2015 to 2018 but it was fairly modest. Maybe this could be a recession signal. If so, I would interpret this as maybe we have a mild recession because of the mild rise in prices. Or, there could be a very severe recession since this 10 year economic recovery wasn’t even strong enough to get commodity prices higher. In the latter case, commodity prices could be in for much lower prices in the next couple years.

Chuck Kowalski

FuturesBuzz.com