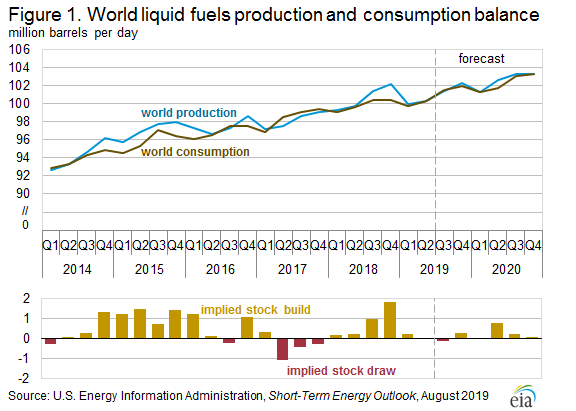

Crude oil futures have been under pressure in recent weeks, as the news and fundamental picture is growing more bearish. The trade war with China has pressured the market along with a rising dollar and weaker outlook for demand worldwide. The biggest issue might be the prospects for the “oil glut” to continue to grow, as the US continues to pump out oil at an increasing rate.

The US Energy Information Administration (EIA) detailed their forecast in the August Short Term Outlook for increased production well into 2020 and demand is not expected to keep pace. One of the biggest worries for the market is that demand could weaker even further as economic activity has been slowing around the world and some countries in Europe are slipping into recession territory. With the trend toward zero interest rates and even negative rates, it makes me wonder what type of monetary policy is left to help their economies.

To me, it looks like the path of least resistance is for economic activity to slow further and there could be further revisions to demand on the downside for oil in the months ahead.

With crude oil prices currently at $54.50, it makes sense to see where prices have traded in the last few years. The range in the last 3 years is around $39 on the low end and about $77 on the high end. So, the current price is near the middle of that range. A quick analysis might imply that prices should trend lower and test the bottom end of the range in the next few months. That is the nickel version of making a longer-term market call, but we know things aren’t always that easy with commodities.

When I dial down to the daily chart to make more of a timing decision, the $50.50 level looks like a solid support level. I have to think this support will probably be tested again. If it does, it will probably fail to hold under this technical setup. That could open the door for a quicker and deeper selloff. That is certainly something I will be watching.

It is not a secret the fundamentals are looking weak and there is no shortage of commentary out there about the supply issues and the other aforementioned concerns. It seems like we have been down this road before, as we are overwhelmed with negative talk on the oil market and it seems like the supply expectation keep ratcheting higher and demand is in question. Then, guess what happens? Yes, we get a cut from OPEC or Russia actually plays along with the game to lower production…and we get a solid rally. I have to say that is in the back of my mind as well. Something always seems to happen to keep this market from falling into the abyss when all the talk gets very negative.

Nonetheless, the fundamentals do look negative until something changes. With the current economic and geopolitical climate, there will undoubtedly be impactful events that could temporarily change this outlook. At this point I would be focusing on selling rallies. Things could get interesting if the market comes back down to test the $50.50 area. Longer-term, I would be looking for the market to drift lower.